Samacheer Kalvi textbook 12th Accountancy Accounts of Not-For-Profit Organisation Text Book Back Questions and Answers

You can Download Accountancy Chapter 1 Accounts from Incomplete Records Questions and Answers, Reduced syllabus Guide Pdf, Samacheer Kalvi textbook 12th Accountancy Book answers Guide Pdf helps you to revise the complete Tamilnadu State Board New Reduced Syllabus and score more marks in your public Examination.

Samacheer Kalvi 12th Accountancy Accounts of Not-For-Profit Organisation Text Book Back Questions and Answers

I. Choose the Correct Answer

Question 1.

Receipts and payments account is a …………….

(a) Nominal A/c

(b) Real A/c

(c) Personal A/c

(d) Representative personal account

Answer:

(b) Real A/c

Question 2.

Receipts and payments account records receipts and payments of …………….

(a) Revenue nature only

(b) Capital nature only

(c) Both revenue and capital nature

(d) None of the above

Answer:

(c) Both revenue and capital nature

Question 3.

Balance of receipts and payments account indicates the …………….

(a) Loss incurred during the period

(b) Excess of income over expenditure of the period

(c) Total cash payments during the period

(d) Cash and bank balance as on the date

Answer:

(d) Cash and bank balance as on the date

Question 4.

Income and expenditure account is a …………….

(a) Nominal A/c

(b) Real A/c

(c) Personal A/c

(d) Representative personal account

Answer:

(a) Nominal A/c

Question 5.

Income and Expenditure Account is prepared to find out …………….

(a) Profit or loss

(b) Cash and bank balance

(c) Surplus or deficit

(d) Financial position

Answer:

(c) Surplus or deficit

Question 6.

Which of the following should not be recorded in the income and expenditure account?

(a) Sale of old news papers

(b) Loss on sale of asset

(c) Honorarium paid to the secretary

(d) Sale proceeds of furniture

Answer:

(d) Sale proceeds of furniture

Question 7.

Subscription due but not received for the current year is …………….

(a) An asset

(b) A liability

(c) An expense

(d) An item to be ignored

Answer:

(a) An asset

Question 8.

Legacy is a …………….

(a) Revenue expenditure

(b) Capital expenditure

(c) Revenue receipt

(d) Capital receipt

Answer:

(d) Capital receipt

Question 9.

Donations received for a specific purpose is …………….

(a) Revenue receipt

(b) Capital receipt

(c) Revenue expenditure

(d) Capital expenditure

Answer:

(b) Capital receipt

Question 10.

There are 500 members in a club each paying ₹ 100 as annual subscription. Subscription due but not received for the current year is ₹ 200; Subscription received in advance is ? 300. Find out the amount of subscription to be shown in the income and expenditure account,

(a) ₹ 50, 000

(b) ₹ 50, 200

(c) ₹ 49, 900

(d) ₹ 49, 800

Answer:

(a) ₹ 50,000

II. Very Short Answer Questions - 2 Marks

Question 1.

State the meaning of not-for-profit organisation.

Answer:

- Some organisations are established for the purpose of rendering services to the public without any profit motive. They may be created for the promotion of art, culture, education and sports, etc. These organisations are called not-for-profit organisation.

Question 2.

What is receipts and payments account?

Answer:

- Receipts and Payments account is a summary of cash and bank transactions of not-for-profit organisations prepared at the end of each financial year. It is a real account in nature.

Question 3.

What is legacy?

Answer:

- It is the amount given to a non-trading concern as per the will. It is like a donation. It appears on the debit side of receipts and payments account, but is not treated as income because it is not of recurring nature. It is a capital receipt.

Question 4.

Write a short note on life membership fees.

Answer:

- Life membership fee is accounted as a capital receipt and added to capital fund on the liabilities side of Balance sheet. It is non – recurring in nature.

Question 5.

Give four examples for capital receipts of not-for-profit organisation.

Answer:

- Life membership fees

- Legacies

- Specific donation

- Sale of fixed assets

Question 6.

Give four examples for revenue receipts of not-for-profit organisation.

Answer:

- Subscription

- Interest on investment

- Interest on fixed deposit

- Sale of old sports material

III. Short Answer Questions - 3 Marks

Question 1.

What is income and expenditure account?

Answer:

- Income and expenditure account is a summary of income and expenditure of a not-for-profit organisation prepared at the end of an accounting year. It is prepared to find out the surplus or deficit pertaining to a particular year. It is a nominal account in nature in which items of revenue receipts and revenue expenditure relating to the current year alone are recorded.

Question 2.

State the differences between Receipts and Payments Account and Income and Expenditure Account.

Answer:

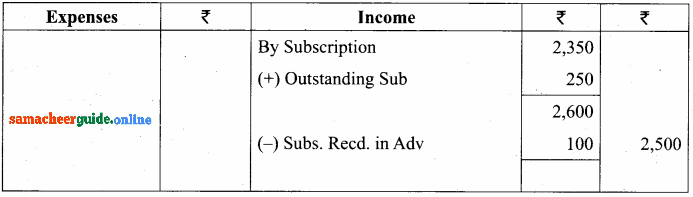

How annual subscription is dealt with in the final accounts of not-for-profit organisation?

Answer:

(A) Treatment in income and expenditure account:

- When subscription received for the current year, previous years and subsequent period are given separately, subscription received for the current year will be shown on the credit side of income and expenditure account after making the adjustments given below:

- Subscription outstanding for the current year is to be added.

- Subscription received in advance in the previous year which is meant for the current year is to be added.

When total subscription received in current year is given:

- Subscription outstanding in the previous year which is received in the current year will be subtracted.

- Subscription received in advance in the previous year which is meant for the current year is added and subscription received in advance must be subtracted.

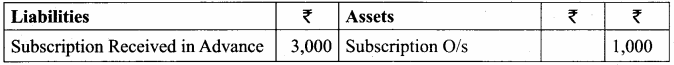

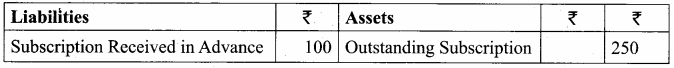

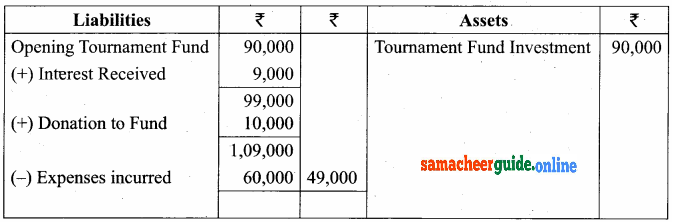

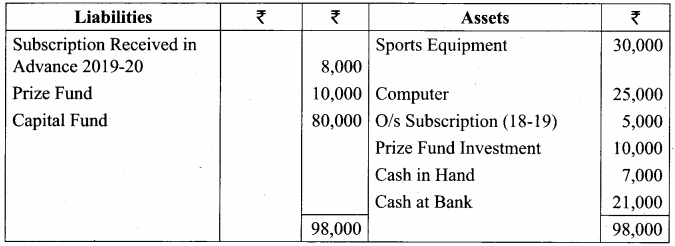

(B) Treatment in Balance sheet:

- Subscription outstanding for the current year and still outstanding for the previous year will be shown on the asset side of the Balance sheet.

- Subscriptions received in advance in the current year will be shown on the liabilities side of the Balance sheet.

How the following items are dealt with in the final accounts of not-for-profit organisation?

- Sale of sports materials

- Life membership fees

- Tournament fund

Answer:

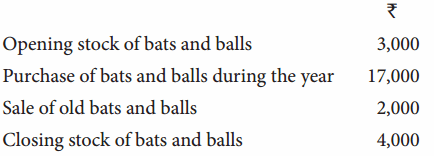

1. Sale of sports materials:

- The sale proceeds of old sports materials like balls and bats, etc., are revenue receipts.

2. Life membership fees:

- Amount received like membership fee from members is a capital receipt as it is non – recurring in nature.

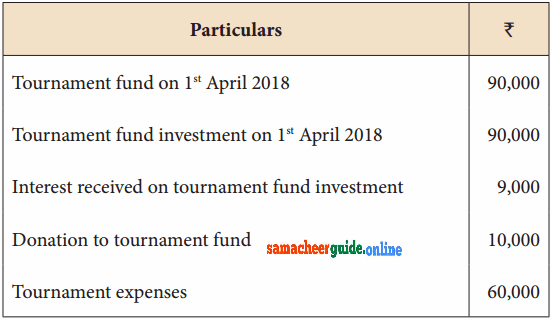

3. Tournament fund:

- It is recurring in nature. It is revenue receipt. It is shown on liabilities side of balance sheet. Opening balance added donations and subtracted expenses incurred.

IV. Exercises - Sums

Question 1.

From the information given below, prepare Receipts and Payments account of Kurunji Sports Club for the year ended 31st December, 2018.

Kurinji Sports Club Account for the year ended 31st Dec 2018

Receipts and Payments

Question 2.

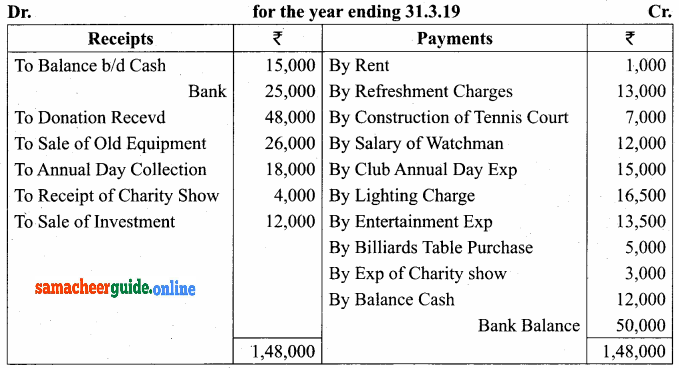

From the information given below, prepare Receipts and Payments account of Coimbatore Cricket Club for the year ending 31st March, 2019.

Answer:

Coimbatore Cricket Club Receipts and Payments Account

for the year ending 31.03.19

Answer:

- Madurai Mother Theresa Mahalir Mandram Receipts and Payments Account for the year ending 31.12.18

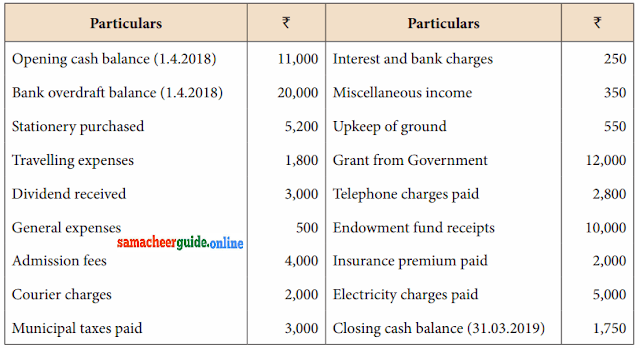

Mayiladuthurai Recreation Club gives you the following details. Prepare Receipts and Payments account for the year ended 31st March, 2019.

Answer:

- Mayiladuthurai Recreation Club Receipts and Payments Account for the year ending 31.3.19

Question 5.

From the following information, prepare Receipts and Payments account of Cuddalore Kabaddi Association for the year ended 31st March, 2019.

- Cuddalore Kabadi Association Receipts and Payments Account for the year ending 31.03.19

Answer:

Answer:

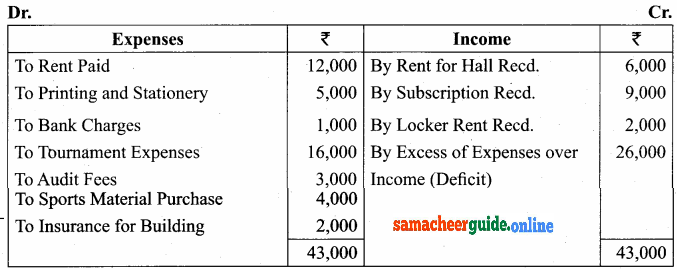

- Tenkasi Thiruvalluvar Manram Income and Expenditure Account for the year ended 31.03.19

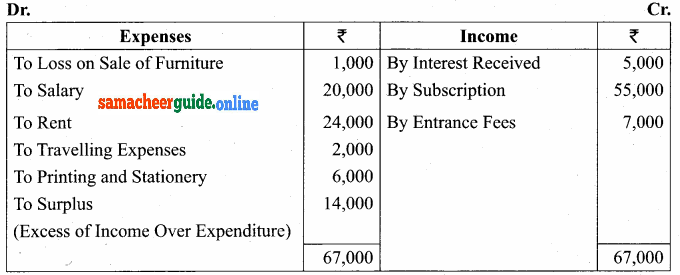

Question 7.

From the following receipts and payments account, prepare income and expenditure account of Kumbakonam Basket Ball Association for the year ended 31st March, 2018.

- Kumbakonam Basket Ball Association Income & Expenditure Account for the year ended 31.03.19

Question 8.

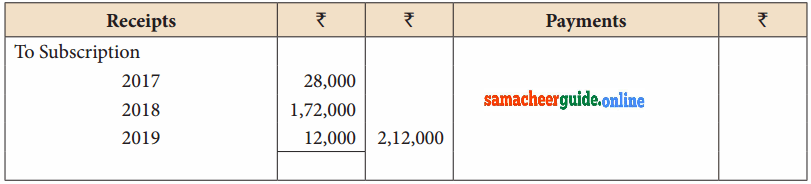

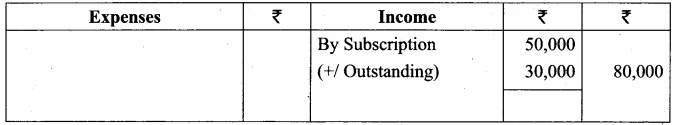

From the following receipts and payments account and the additional information given below, calculate the amount of subscription to be shown in Income and expenditure account for the year ending 31st December, 2018.

Answer:

- Income and Expenditure Account for the year ended 31.12.18

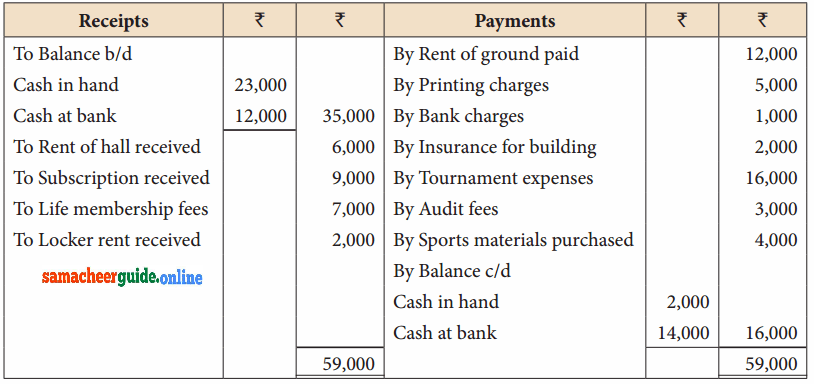

Question 9.

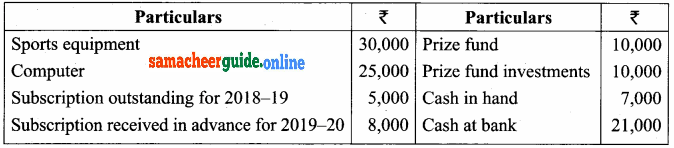

How the following items will appear in the final accounts of a club for the year ending 31st March 2019?

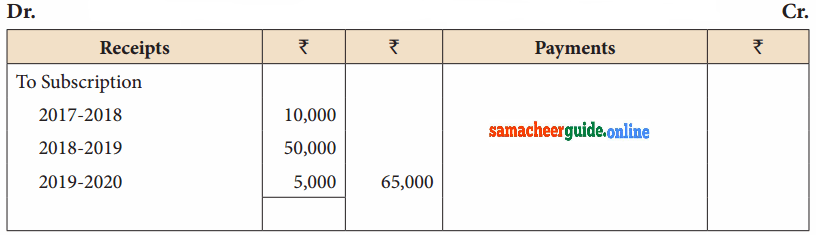

Receipts and Payments Account for the year ended 31st March, 2019

Answer:

- There are 200 members in the club each paying an annual subscription of ₹ 400 per annum. Subscription still outstanding for the year 2017 – 2018 is ₹ 2,000.

- Income & Expenditure Account for the year ended 31.03.2019

Balance Sheet as on 31.03.19

Question 10.

How will the following items appear in the final accounts of a club for the year ending 31st March 2017? Received subscription of ₹ 40,000 during the year 2016 – 17. This includes subscription of ₹ 5,000 for 2015 – 16 and ₹ 3,000 for the year 2017 – 18. Subscription of ₹ 1,000 is still outstanding for the year 2016 – 17.

Answer:

- Income & Expenditure Account for the year ended 31.03.19

Question 11.

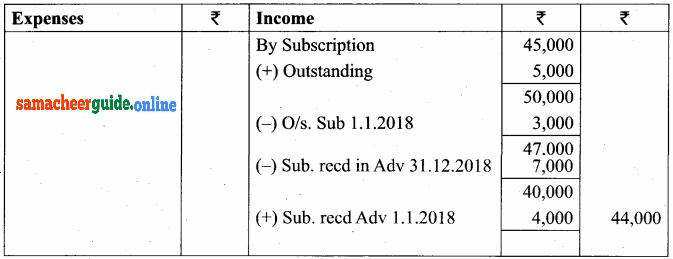

Compute income from subscription for the year 2018 from the following particulars relating to a club.

Answer:

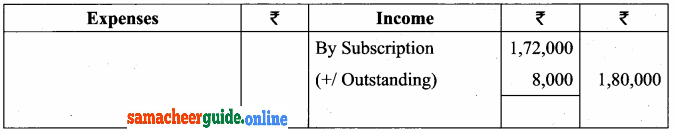

- Subscription received during the year 2018: ₹ 45,000. Income & Expenditure Account for the year ended 31.03.2019

Question 12.

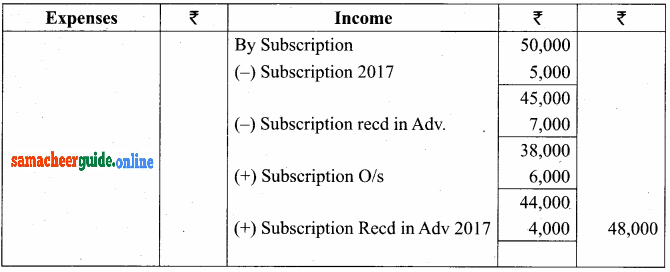

From the following particulars, show how the item ‘subscription’ will appear in the Income and Expenditure Account for the year ended 31 – 12 – 2018?

Subscription received in 2018 is ₹ 50,000 which includes ₹ 5,000 for 2017 and ₹ 7,000 for 2019. Subscription outstanding for the year 2018 is ₹ 6,000. Subscription of ₹ 4,000 was received in advance for 2018 in the year 2017.

Answer:

- Income and Expenditure Account for the year ended 31.12.2018

Question 13.

How the following items appear in the final accounts of Thoothukudi Young Pioneers Association?

There are one hundred members in the association each paying ₹ 25 as annual subscription. By the end of the year 10 members had not paid their subscription but four members had paid for the next year in advance.

Income & Expenditure Account for the year ended

Answer:

Balance Sheet as on …………..

Question 14.

How will the following appear in the final accounts of Marthandam Women Cultural Association?

Answer:

- Income and Expenditure Account for the year ended 31.03.19

- Balance Sheet as on 31.03.19

Question 15.

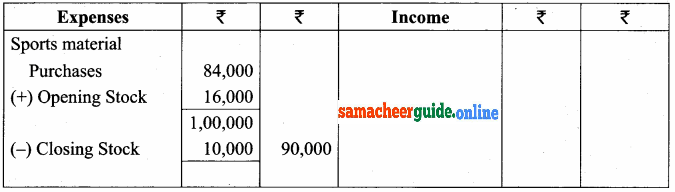

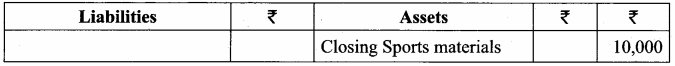

How will the following appear in the final accounts of Vedaranyam Sports club?

Answer:

Income & Expenditure Account for the year ended

Balance Sheet as on …………..

Question 16.

Show how the following items appear in the income and expenditure account of Sirkazhi Singers Association?

Answer:

- Income and Expenditure Account for the year ended 31.03.18

Question 17.

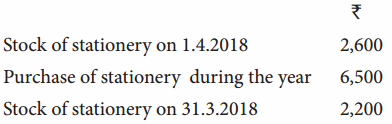

Chennai tennis club had Match fund showing credit balance of ₹ 24,000 on 1st April, 2018. Receipt to the fund during the year was ₹ 26,000. Match expenses incurred during the year was ₹ 33,000. How these items will appear in the final accounts of the club for the year ended 31st March, 2019?

Balance Sheet as on 31.03.2019

Answer:

- Income and Expenditure Account for the year ended 31.03.18

Question 18.

How will the following appear in the final accounts of Karaikudi sports club for the year ending 31stMarch, 2019?

Answer:

- Balance Sheet as on 31.03.19

Question 19.

Compute capital fund of Salem Sports Club as on 1.4.2019.

Answer:

- Balance Sheet as on 01.04.2019

Question 20.

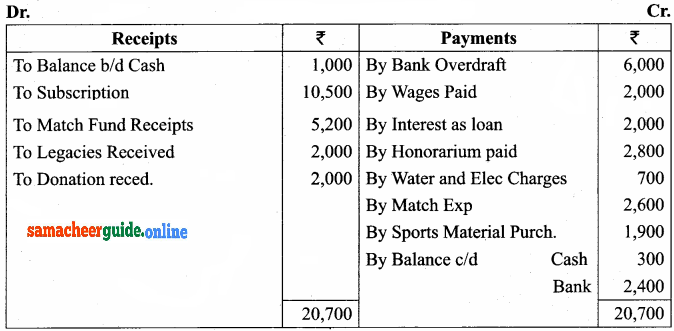

From the following Receipts and Payments account and from the information given below of Ramanathapuram Sports Club, prepare Income and Expenditure account for the year ended 31st December, 2018 and the balance sheet as on that date.

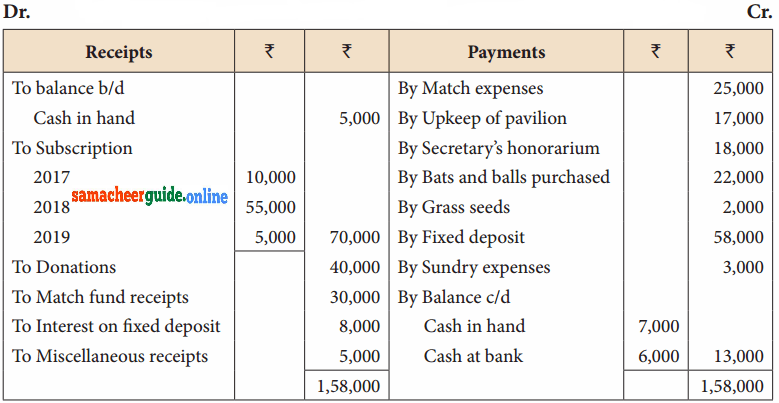

Receipts and Payments Account for the year ended 31st December, 2018

Additional information:

Capital fund as on 1st January 2018 ₹ 30,000.

Opening stock of sports material ₹ 3,000 and closing stock of sports material ₹ 5,000.

Answer:

Income and Expenditure Account for the year ended 31.12.18

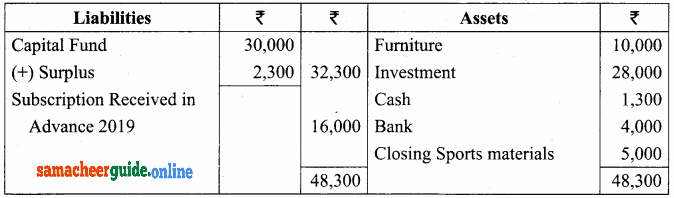

Balance Sheet as on 31.12.18

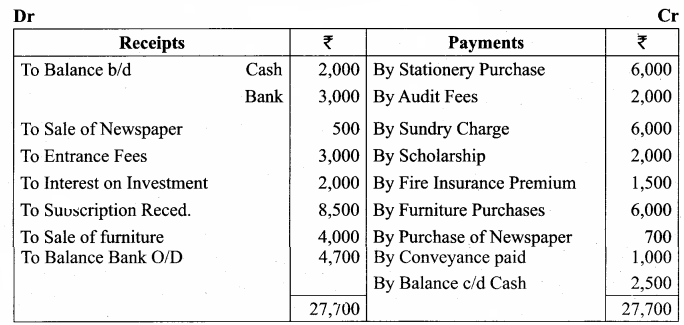

Question 21.

From the following Receipts and Payments account of Yercaud Youth Association, prepare Income and expenditure account for the year ended 31st March, 2019 and the balance sheet as on that date.

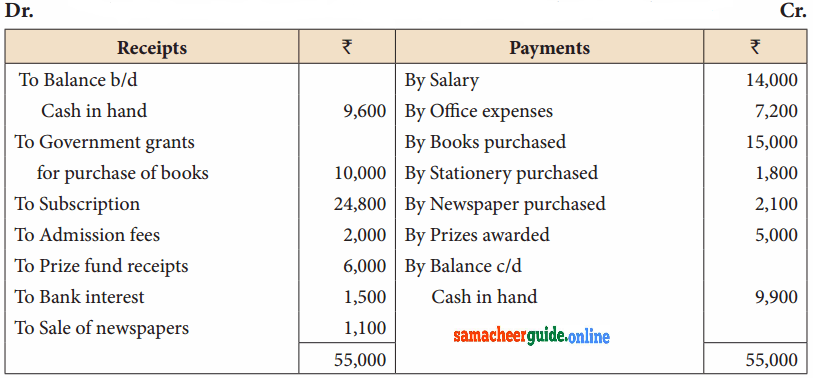

Receipts and Payments Account for the year ended 31st March, 2019

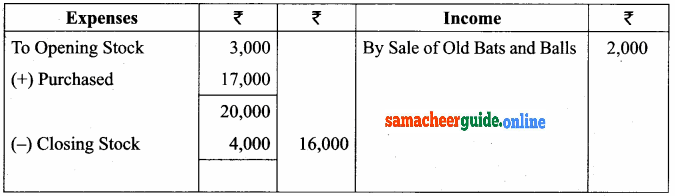

Additional information:

Opening capital fund ₹ 20,000.

Stock of books on 1.4.2018 ₹ 9,200.

Subscription due but not received ₹ 1,700.

Stock of stationery on 1.4.2018 ₹ 1,200 and stock of stationery on 31.3.2019, ₹ 2,000

Income and Expenditure Account for the year ended 31.03.19

- Balance Sheet as on 31.03.2019

Question 22.

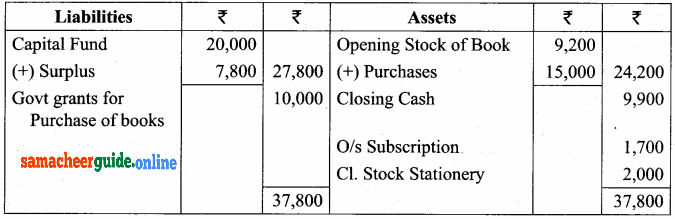

Following is the Receipts and Payments account of Neyveli Science Club for the year ended 31st December, 2018.

Receipts and Payments Account for the year ended 31st December, 2018

Additional information:

Opening capital fund ₹ 6,400

Subscription includes ₹ 600 for the year 2019

Science equipment as on 1.1.2018 ₹ 5,000

Surplus on account of exhibition should be kept in reserve for new auditorium.

Prepare income and expenditure account for the year ended 31st December, 2018 and the balance sheet as on that date.

Answer:

- Income and Expenditure Account for the year ended 31.12.18

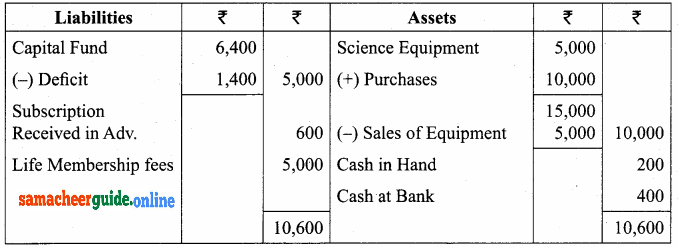

- Balance Sheet as on 31.12.2018

Question 23.

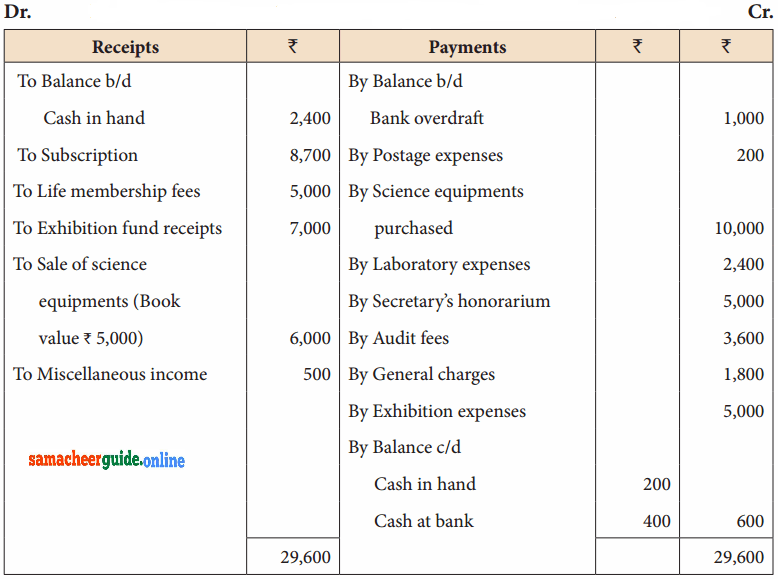

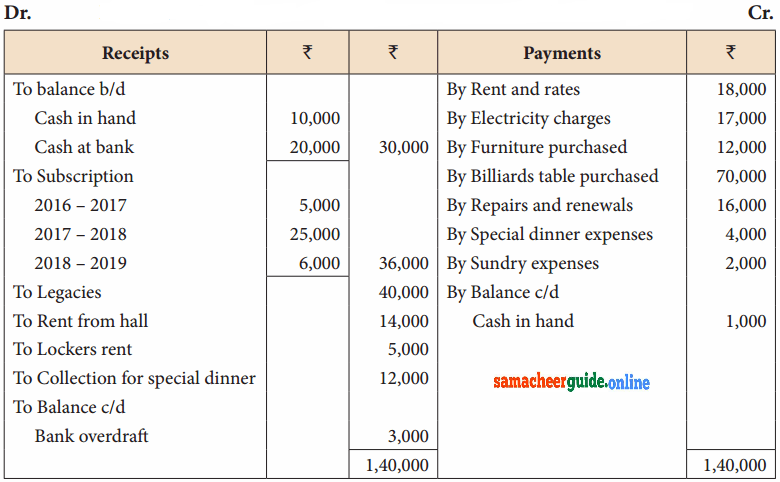

From the following Receipts and Payments account of Sivakasi Pensioner’s Recreation Club, prepare income and expenditure account for the year ended 31st March, 2018 and the balance sheet as on that date.

Receipts and Payments Account for the year ended 31st March, 2018

Additional information:

The club had 300 members each paying ₹ 100 as annual subscription.

The club had furniture ₹ 10,000 on 1.4.2017.

The subscription still due but not received for the year 2016 – 2017 is ₹ 1,000.

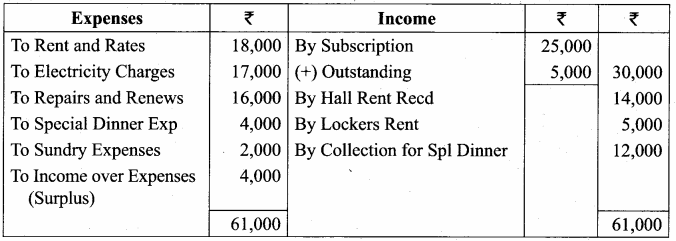

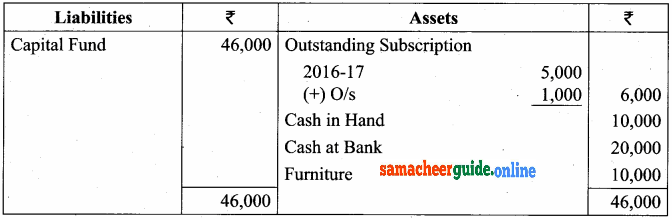

Income and Expenditure Account for the year ended 31.03.18

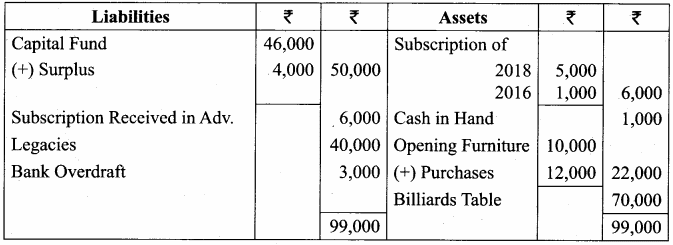

- Opening Balance Sheet as on 1.1.18

Balance Sheet as on 31.12.2019

Question 24.

Following is the Receipts and payments account of Virudhunagar Volleyball Association for the year ended 31st December, 2018.

Receipts and Payments Account for the year ended 31st December, 2018

Answer:

Additional information:

On 1.1.2018, the association owned investments ₹ 10,000, premises and grounds ₹ 40,000, stock of bats and balls ₹ 5,000.

Subscription ₹ 5,000 related to 2017 is still due.

Subscription due for the year 2018, ₹ 6,000.

Prepare income and expenditure account for the year ended 31st December, 2018 and the balance sheet as on that date.

Answer:

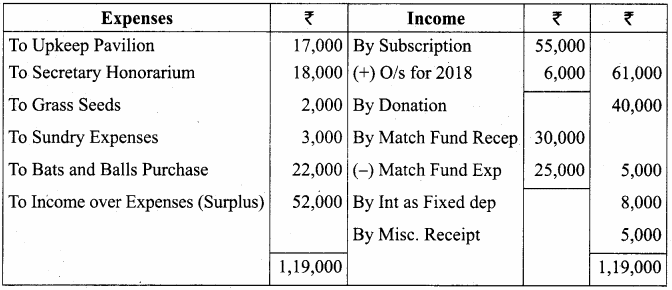

Income and Expenditure Account for the year ended 31.12.18

- Opening Balance Sheet as on 1.1.18

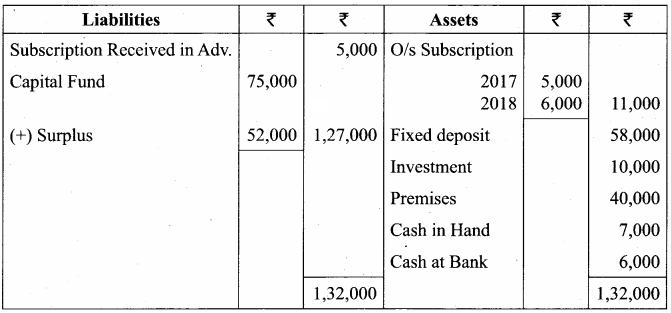

Balance Sheet as on 31.12.2109

Samacheer Kalvi 12th Accountancy Accounts of Not-For-Profit Organisation

Additional Questions and Answers

I. Choose the correct answer

Question 1.

State the primary motive of not-for-profit organisation?

(a) Producing goods

(b) Provide service

(c) Both

(d) None of these

Answer:

(b) Provide service

Question 2.

State the nature of Life membership subscription.

(a) Cash Payments

(b) Cash Receipts

(c) Capital Receipt

(d) None of these

Answer:

(b) Cash Receipts

Question 3.

On which basis Receipt and Payment Account is prepared?

(a) Cash basis

(b) Credit basis

(c) Accrual basis

(d) None of these

Answer:

(a) Cash basis

Question 4.

Classify the subscription received during the year of not-for-profit organisation.

(a) Capital Receipt

(b) Capital Expenditure

(c) Revenue Receipt

(d) Both

Answer:

(c) Revenue Receipt

Question 5.

State the nature of Receipt and Payment A/c for not-for-profit organisation.

(a) Real Account

(b) Personal A/c

(c) Nominal A/c

(d) Representative Personal A/c

Answer:

(a) Real Account

Question 6.

Subscription received in advance is

(a) An Asset

(b) Income

(c) A Liability

(d) Expenditure

Answer:

(c) A Liability

II. Fill in the blanks

Question 7.

Not-for-profit organisation set up with the objective of ……………. of the society.

Answer:

Welfare

Question 8.

The nature of Receipt and Payments Account is …………….

Answer:

An Asset

Question 9.

Receipt and Payment Account is prepared as ……………. basis of accounting.

Answer:

Cash

Question 10.

Nature of Income over Expenditure Account is …………….

Answer:

Nominal Account

Question 11.

Excess of Income over Expenditure, the result is …………….

Answer:

Real surplus Account

Question 12.

Excess of Expenditure over the Income, the result is …………….

Answer:

Definite Liability

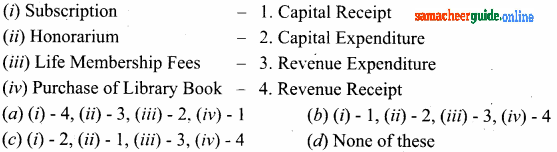

III. Match the following

Question 13.

Answer:

(a) 4, 3, 1, 2

Question 14.

Answer:

(a) 4, 3, 1, 2